Our Guide to Getting a Free or Reduced-Price Medical Alert System

Are medical alert systems out of your budget?

You may be eligible for a free life alert system, also called a medical alert system, through five plans or programs: Medicare Advantage, long-term care insurance, a home and community-based services Medicaid waiver, Veterans Affairs, or your local area agency on aging. If you don’t meet the requirements for a free medical alert system, consider an affordable monitored option or an unmonitored device with no monthly fees.

We put together this guide to help you learn how to verify your insurance coverage, how to find a Medicaid waiver, what to expect when contacting an area agency on aging, and more.

Why do you need a medical alert system?

- Medical alert systems call for help at the touch of a button, making them faster and easier to use than a cell phone in an emergency.

- People who spend time alone and are at risk of falling can use a medical alert system to get help quickly.

- Medical alert devices with GPS share your real-time location with first responders, so you can confidently leave your house knowing help will reach you wherever you are.

- You can also use your medical alert system for non-medical emergencies, such as break-ins or house fires.

How much does a medical alert system cost?

Medical alert systems that connect to a monitoring centerⓘ Monitoring center staff members answer calls 24/7. They have the user’s address, care preferences, and emergency contacts on file, which they can pass on to 911 if needed. cost $20 per month and up. Mobile systems and fall detection devices cost more than basic in-home systems, so their total monthly cost could reach $60.

Equipment fees range from $0 (for leased devices) to $350 upfront. Medical alert necklaces and medical alert bracelets cost the same in a basic home system, but necklaces with fall detection cost about $10 extra per month.

Activation fees cost $0–$50, and shipping fees depend on location and delivery speed. Most medical alert systems don’t require an installation fee.

Medical alert systems with no monthly fees cost $30–$450. Because these devices don’t include monitoring services and rarely offer GPS tracking or fall detection, they’re not as reliable or useful as traditional medical alert systems. That said, they may be an appropriate solution for people who have a responsive local support network and low fall risk.

Learn more about the cost of a medical alert system, and use NCOA’s Falls Free Checkup to measure fall risk.

How do I get a medical alert system for free or at a reduced price?

Check these five options to see if you qualify for a discounted or free medical alert system:

- Long-term care insurance

- Medicare Advantage insurance

- Medicaid waiver

- Veterans Affairs

- Area agency on aging

Check your long-term care insurance policy

Medical alert systems may be covered under your long-term care policy. To check, you can call your insurance company for assistance, or view your policy’s summary of benefits and coverage (SBC) or evidence of coverage documents. These documents should be available online, but you can also request a copy to be mailed to you.

Each insurance company designs its SBC a bit differently, and some are easier to interpret than others. In this Mutual of Omaha long-term care sample, medical alert system coverage is explicitly named in the supplemental benefits section. [1]Mutual of Omaha Insurance Company. Comprehensive Individual Long-Term Care Insurance policy. Found on the internet at https://steveshorr.com/steveshorr/life_estate_planning/ltc/barry.fisher/mutual.omaha/Mutual%20of%20Omaha%20Solutions.full.policy.pdf

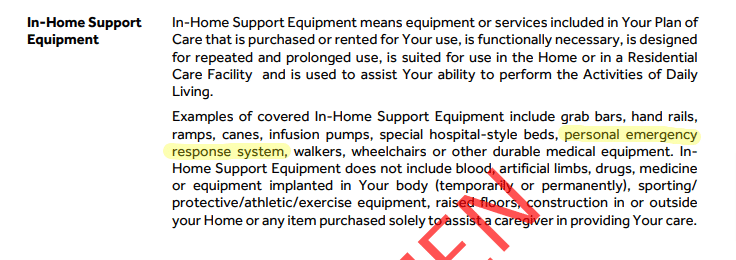

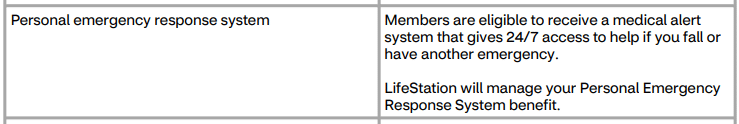

This sample long-term care policy from New York Life lists personal emergency response systems (another name for medical alert systems) in the definition of in-home support equipment. The document later explains that such equipment is covered only when it helps you stay in your home for at least 90 days, among other criteria. [2]New York Life Insurance Company. Long-Term Care Insurance Policy. Found on the internet at https://www.newyorklife.com/content/dam/nyl/docs/pdfs/nyl-internet/file-types/Sample-LTC-Ins-Policy-NYL-Secure-Care-CA.pdf

Both insurance companies require a health care professional to design a plan of care for the beneficiary. If a medical alert system is not mentioned in this plan of care, it won’t be covered. Look for similar restrictions when reviewing your own long-term care policy.

Long-term care policies may require the system to be used solely in the home, which would make a mobile medical alert ineligible for coverage. In some cases, the insurance policy won’t cover shipping, activation, or extended warranty fees.

Check your Medicare Advantage plan

Medicare Advantage, also called Medicare Part C, may cover medical alert systems. Coverage varies by plan, so as with long-term care policies, check the SBC for any mention of medical alerts or personal emergency response systems that might be covered by your Medicare Advantage plan.

According to Stephanie Pogue, a certified Medicare insurance planner in Missouri, Medicare Advantage plans rarely require prior authorization from the insurance company before you can get a medical alert system. “In most cases I’ve seen, they do not need any authorization or doctor’s notes. You qualify just because you have the insurance plan,” Pogue said.

Pogue also told us some Medicare Part C policies only cover medical alert equipment from a particular company. For example, Aetna partners with LifeStation to send its beneficiaries a free medical alert system. “Often, the cost of the device and the monthly service is covered,” Pogue added.

If you don’t have a Medicare Advantage plan, you may be eligible for a program of all-inclusive care for the elderly (PACE), which often covers personal emergency response systems as part of their comprehensive programming.

Will original Medicare pay for a medical alert system?

Medicare Part A and Part B, also known as original Medicare, don’t pay for medical alert systems.

“Unfortunately, there are no exceptions allowing for people to use Medicare Part A and B for covering medical alert systems,” said Community Health of South Florida, Inc. Chief Financial Officer Jeremy Radziewicz, MAcc. “Medicare A and B will not cover medical alert systems as they are not considered to be so-called durable medical equipment (DME).”

Will a doctor’s note help me get insurance coverage for medical alert systems?

A doctor’s note won’t change the terms of your policy, but it may influence how the policy is interpreted. If your insurance plan covers medical alert systems but you’ve been denied, consider asking your doctor to explain, in writing, why you need the system.

“A doctor’s note does not necessarily help people get insurance coverage for medical alert systems,” said Radziewicz. “It really depends on your specific plan and its covered benefits. If it’s listed as a covered benefit in your plan, then a doctor’s note will help, but if it’s not listed in the plan, it won’t.”

Apply for a Medicaid waiver

A Medicaid waiver allows some people to get financial assistance from their state when they don’t meet the traditional requirements for Medicaid enrollment. Many states offer home- and community-based services 1915(c), Medicaid waivers that help people age 65 and older access the equipment and services they need to live in their own homes—including medical alert systems. [3]Centers for Medicare and Medicaid Services. National Overview of 1915(c) HCBS Waivers. Sept. 6, 2023. Found on the internet at https://www.cms.gov/Outreach-and-Education/American-Indian-Alaska-Native/AIAN/LTSS-TA-Center/info/national-overview-1915-c-waivers

Use BenefitsCheckUp® to find Medicaid waivers for home- and community-based services in your area.

- Enter your ZIP code and click the arrow to be taken to the categories page.

- Select Aging in Place and click next.

- Click again on Aging in Place and look for Home and Community-Based Waiver.

- If it’s available in your community, it will come up in the list of programs. (The program may have a different name, such as Assisted Living for the Elderly [ALE] Waiver).

- Click View More Info. Look for Personal Emergency Response System (or similar) in the list of services.

If you don’t see personal emergency response system on the list, scroll down and click Who should I contact? to view the program’s phone number. Call to verify medical alert system coverage, as it may be available under a different name, like environmental modifications or home adaptations.

Once you’ve found the right Medicaid waiver, you can click the Apply Online button and fill out an application through your state’s Medicaid website.

Arizona, New Jersey, Rhode Island, and Vermont do not currently offer home and community-based Medicaid waivers. [4] Medicaid.gov. State Waivers List. Found on the internet at https://www.medicaid.gov/medicaid/section-1115-demo/demonstration-and-waiver-list/index.html?f%5B0%5D=state_waiver_status_facet%3A1561&f%5B1%5D=waiver_authority_facet%3A1571#content#content

Apply for a free medical alert button through Veterans Affairs

The Department of Veterans Affairs (VA) provides free medical alert devices to eligible veterans. You must visit your local VA and tell them you want a medical alert system. After a health care provider determines your eligibility, VA orders the system for you. [5]MedEquip Alert. Mobile Personal Emergency and Medical Alert Device for Veterans. Found on the internet at https://www.medequipalert.com/veterans/ [6]Latitude. How to Get a Latitude Alert. Found on the internet at https://golatitude.com/veterans/

Available free medical alerts for veterans include:

- MedEquip Alert (professionally monitored)

- Latitude (calls and texts up to six contacts)

- LogicMark Guardian Alert 911 Plus (calls 911)

Veterans in nursing homes or assisted living care programs usually aren’t eligible for these free devices.

Tricare for Life, a free supplemental program for veterans enrolled in Medicare Parts A and B, doesn’t cover living space alterations, safety medical supplies, or long-term care, so it’s unlikely to cover medical alert systems. [7] Tricare. Covered Services: Exclusions. June 18, 2020. Found on the internet at https://www.tricare.mil/CoveredServices/IsItCovered/Exclusions Contact your case manager to discuss exceptions.

Contact your local area agency on aging

Area agencies on aging (AAA) provide support services to older adults. Some give financial assistance for medical alert systems or can connect you to local companies that offer more affordable prices than national brands.

We contacted several agencies to learn about medical alert availability and common eligibility requirements.

The Kentucky Regional Planning and Development Agency (KIPDA), for example, can provide discounted medical alert systems to people enrolled in the home services program, which helps with light housework and other chores. A KIPDA representative told us this program depends on available funding, so a free medical alert system isn’t guaranteed. They also gave us the phone number of a local medical alert company that could provide a $10–$20 monthly discount on a system.

Through its emergency home response service program, the Illinois Department on Aging provides free medical alert systems to Illinois residents age 60 or older who meet financial and physical criteria. The systems are also delivered and installed free of charge.

The Merced County area agency on aging in California takes a unique approach by providing free emergency cell phones. The phones have been donated and aren’t connected to a monthly plan. For that reason, they can only be used to dial 911 in an emergency. People looking for free life alert systems are referred to other resources, like Medicaid waivers, private insurance, or low-cost devices.

AAAs can also help you navigate the Medicaid waiver application process for medical alert system coverage.

Bottom line

It’s possible to get a free medical alert system with the right insurance plan, or with support from a group like Veterans Affairs or your local area agency on aging.

Don’t hesitate to advocate for yourself or your care recipient to make sure the medical alert system has appropriate safety features, like automatic fall detection.

To learn more about common medical alert features, read our review of the best medical alert systems.

Frequently asked questions

No, not directly. We asked national brands like MobileHelp and Bay Alarm Medical whether they offer any financial assistance beyond periodic sales. None of the companies we contacted run charitable programs, but some do partner with insurance companies or state Medicaid waiver programs. For example, Montana residents eligible for the Big Sky Waiver can get a free ADT medical alert system.

Medicare Part A and Part B, also known as original Medicare, don’t pay for medical alert systems. Medicare Advantage, also called Medicare Part C, may cover medical alert systems, but Medicare Advantage varies by plan. Check your policy’s summary of benefits and coverage (SBC) for any mention of medical alerts or personal emergency response systems that might be covered by your plan, or talk to a representative with your insurance company.

Private health insurance plans usually do not cover medical alert systems unless the policy is for long-term care. Some Medicaid health insurance plans also cover medical alerts. Learn more about insurance coverage for medical alert systems.

Veterans aging at home may be eligible for a free medical alert device through the Department of Veterans Affairs (VA). Visit your local VA and tell them you want a medical alert system. After a health care provider determines your eligibility, VA will order a system for you.

Veterans Affairs can help pay for a medical alert system. Your local area agency on aging may be able to provide a discounted or free medical alert device, but each agency has different programs, policies, and funding.

AARP offers a 15% discount for Lifeline medical alert systems and invisaWear emergency buttons. Even with the AARP discounts, these products are more expensive than alternatives from companies like Medical Guardian or Bay Alarm Medical.

Learn more about medical alert systems for AARP members.

The most affordable monitored medical alert system is the MobileHelp Classic, which starts at $19.95 per month. Medical alert systems with no monthly fees start at about $30. If you need a medical alert system with fall detection, expect to pay at least $30–$40 per month.

No, we’re not aware of any insurance plans or programs that provide free systems made by the Life Alert brand. Life Alert systems are the most expensive options on the market, they don’t have the best features, and it’s difficult to exit a Life Alert plan if you decide you no longer want to use the service. Learn more in our Life Alert review.

Have questions about this review? Email us at reviewsteam@ncoa.org.

Sources

- Mutual of Omaha Insurance Company. Comprehensive Individual Long-Term Care Insurance policy. Found on the internet at https://steveshorr.com/steveshorr/life_estate_planning/ltc/barry.fisher/mutual.omaha/Mutual%20of%20Omaha%20Solutions.full.policy.pdf

- New York Life Insurance Company. Long-Term Care Insurance Policy. Found on the internet at https://www.newyorklife.com/content/dam/nyl/docs/pdfs/nyl-internet/file-types/Sample-LTC-Ins-Policy-NYL-Secure-Care-CA.pdf

- Centers for Medicare and Medicaid Services. National Overview of 1915(c) HCBS Waivers. Sept. 6, 2023. Found on the internet at https://www.cms.gov/Outreach-and-Education/American-Indian-Alaska-Native/AIAN/LTSS-TA-Center/info/national-overview-1915-c-waivers

- Medicaid.gov. State Waivers List. Found on the internet at https://www.medicaid.gov/medicaid/section-1115-demo/demonstration-and-waiver-list/index.html?f%5B0%5D=state_waiver_status_facet%3A1561&f%5B1%5D=waiver_authority_facet%3A1571#content#content

- MedEquip Alert. Mobile Personal Emergency and Medical Alert Device for Veterans. Found on the internet at https://www.medequipalert.com/veterans/

- Latitude. How to Get a Latitude Alert. Found on the internet at https://golatitude.com/veterans/

- Tricare. Covered Services: Exclusions. June 18, 2020. Found on the internet at https://www.tricare.mil/CoveredServices/IsItCovered/Exclusions