Trust & Will Review (2025)

Key Takeaways

- Trust & Will is our pick for “Best Customer Assistance” out of the eight online will makers we reviewed.

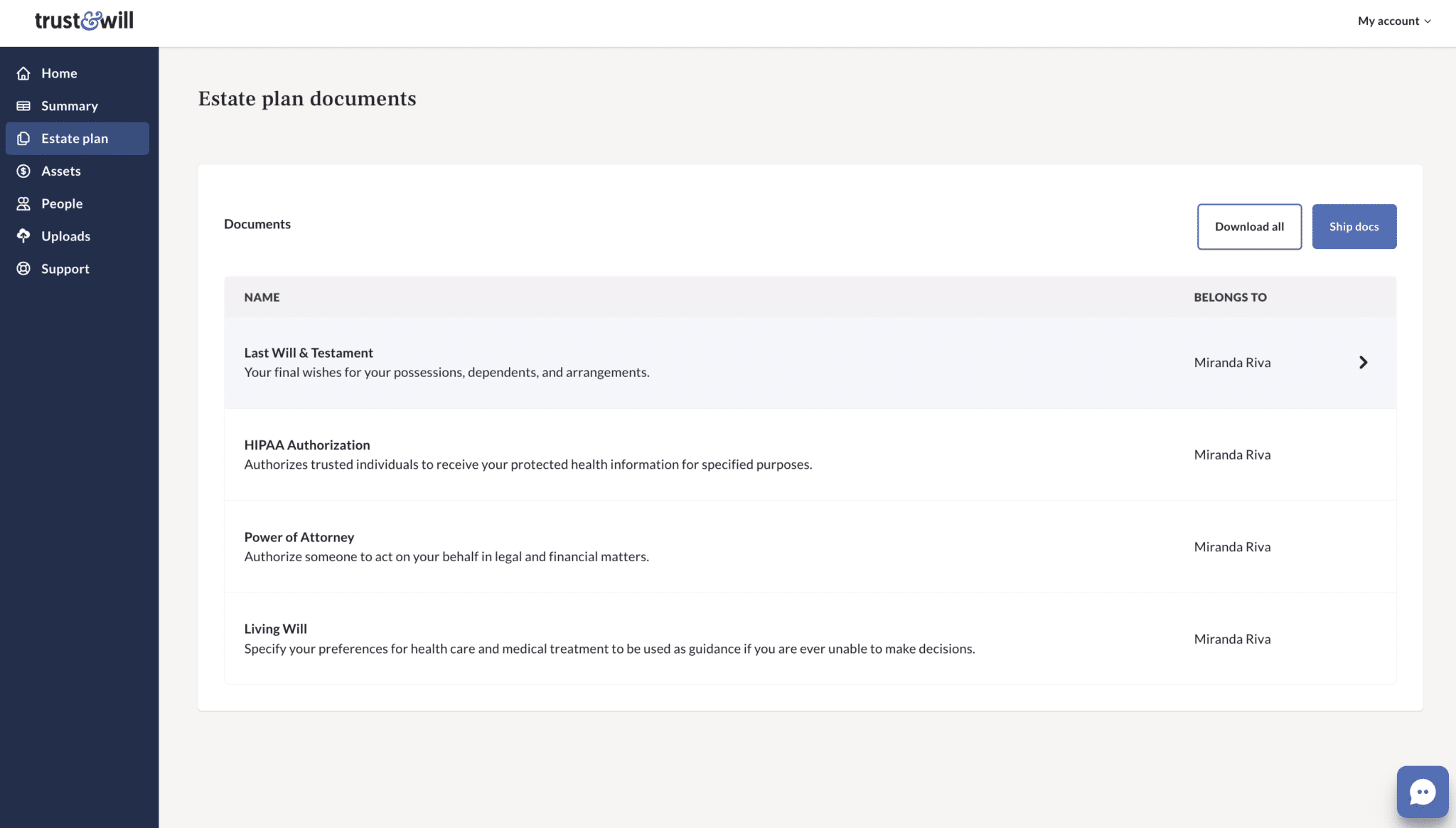

- The will package from Trust & Will includes four documents: last will and testament, living will, HIPAA authorization form, and power of attorney.

- Trust & Will offers customized, state-specific wills for $199 (single person) or $299 (couples) that can be paid up front or in four interest-free installments.

Trust & Will is an online estate planning service that has quickly become one of the most recognizable on the market. Since it started in 2017, Trust & Will has helped more than 200,000 customers plan their estates and handle probate affairs. Estate planning attorneys have designed and approved all available documents, which are covered by the company’s money-back satisfaction guarantee.

Our team gave the Trust & Will online will maker service 4.6 out of 5 stars. Overall, the basic package is an affordable price point and offers high-quality, easy-to-generate documents. We chose Trust & Will as our pick for “Best Customer Assistance” in our roundup of the best online will makers because it offers thorough, friendly assistance throughout every stage of the estate planning process. Unlike competitors that only make assistance available after purchase, we were able to access a Trust & Will customer representative before making a purchase to answer our questions about how to prepare to use the platform. A representative also helped our team through the questionnaire process and answered lingering questions we had once our documents were prepared.

Although our team never had to wait more than an hour to hear back from a representative, if you want more information about a topic without any wait, Trust & Will also has an expansive Learn Center with hundreds of articles that are easy to find and understand.

You might be wondering how Trust & Will compares to other online will-making services. This article will provide an in-depth look at the Trust & Will online will service. For a side-by-side comparison of the top will makers in the industry, see our best online will maker review.

Why you should trust us

Our team is made up of credentialed attorneys who spent more than 200 hours researching and using the online will-making services we reviewed, so we can help you decide which is best for you. Out of eight total services we researched, we chose Trust & Will as our “Best Online Will Maker for Customer Assistance.” We came to this conclusion based on:

- Our personal experience as a user creating a will on the platform

- Our practical knowledge of estate law

- Conversations with the attorneys who consulted on the will-writing software

- Analysis of customer reviews on trusted third-party platforms

Trust & Will pros and cons

Trust & Will online will maker features

Most competitors in the online will industry offer a basic last will and testament for a base price and other estate planning documents for additional fees. Trust & Will offers a will-based estate plan for $199 that provides:

How it works

First, gather important documents and other information you’ll need to complete the Trust & Will click-through questionnaire, such as:

- Primary bank account information (checking and savings)

- Retirement and other investment account information

- Life insurance policy numbers

- Proof of ownership of assets (car title or deed to your home)

- Full name(s) and contact information of the executor(s) ⓘThe executor is the individual responsible for distributing the estate and carrying out the wishes in a will. of your estate

- Full names and contact information for all individuals you plan to name in your estate planning documents (living will agent, power of attorney agent)

All legal forms are tailored to meet state laws, so you’ll need to select the state where you live before starting the process. Next, you’ll need to create an account using your email address and a password. After creating an account and making a purchase, you will need to complete a click-through questionnaire.

Answer a series of personal and financial questions to generate the last will and testament, living will, power of attorney, and HIPAA authorization forms. Your responses can be as simple or as detailed as you want. For example, when asked about retirement and bank accounts you can simply list the name of your banking institutions, or you can provide account numbers and asset value estimations.

Trust & Will estimates the questionnaire takes most users 15 minutes to an hour to complete. The amount of time it will take varies depending on how detailed your responses are. Our team gathered the above relevant information ahead of time and gave as much detail as possible, and it took us 30 minutes to complete.

After completing the questionnaire, you can download your documents immediately, or you can choose to have Trust & Will ship paper documents to you. When you have the documents in hand (by download and print or mail), take them to your local bank or even a UPS store to get them notarized. The cost of notarization varies by state, but it’s usually $5–$15. [1] National Notary Association. 2024 Notary Fees By State. Found on the internet at https://www.nationalnotary.org/knowledge-center/about-notaries/notary-fees-by-state After this step, the documents are valid and legally binding.

Helpful hint: To further secure your documents, we suggest enabling the two-step verification feature as soon as you finish the questionnaire. This option is under the “Home” tab and is the first option under the “Additional Tasks” tab.

Will-based estate planning documents

Rather than offering just a single last will and testament document, Trust & Will offers four important estate planning documents in its basic package option. While each document, once signed, serves a separate purpose and is legally binding on its own, having all four ensures that you don’t have gaps in your estate plan.

Last will and testament

A last will and testament, also called a “will,” allows you to designate an executor and leave instructions about how you want to distribute your assets and any other specific requests. Candace Dellacona, Esq., an estate planning attorney in New York for the last 20 years, added that “a will can protect your loved ones by ensuring that they receive their inheritance in an efficient way. It can also contain provisions to protect the beneficiary from creditors or even from himself with provisions that address the testator’s concerns.”

Trust & Will makes it easy to customize your will by:

- Appointing guardians (for children and pets)

- Specifying beneficiaries (and backup beneficiaries)

- Creating an itemized list of gifts

- Electing digital executors (who can access any online accounts you have)

Living will

A living will, sometimes called a health care directive, allows you to leave instructions and elect an agent to represent your health interests if you become incapacitated, which means you are unable to care for or make decisions for yourself. Within this document, you can set limits for your agent and leave notes with further details about any response you provide. You can tailor this document to meet your preferences, just like your last will. Trust & Will allows you to customize each medical decision as well as end-of-life and post-death decisions.

HIPAA authorization form

HIPAA (Health Insurance Portability and Accountability Act) was enacted to, among other things, protect the privacy of an individual’s medical records. When you create a health care directive, you are electing another person to make decisions about your health in the event you are unable to. [2] HHS.gov. Your Rights Under HIPAA. Found on the internet at https://www.hhs.gov/hipaa/for-individuals/guidance-materials-for-consumers/index.html

To make the most informed decision, your agent will need to know the details of your medical history. Without a signed HIPAA authorization form, that information will remain sealed. Trust & Will provides the HIPAA authorization form with the living will document for no additional cost.

Power of attorney

A power of attorney (POA) is a document that assigns an agent to represent you in other non-health-related affairs, like paying bills, handling insurance matters, and making investment decisions.

Trust & Will generates a durable POA, which is effective once it’s signed and only terminates with your death, unlike nondurable POAs, which terminate if you are unable to make decisions on your behalf. Since a durable POA doesn’t terminate if you become incapacitated, it ensures someone is authorized to manage your affairs and make decisions on your behalf if that is ever needed.

The will-based estate package has a specific form you need to sign that follows the laws of your state, so this form will vary depending on where you live. For example, the form generated under Virginia law designates an agent to act “with respect to any matters and any affairs.” [3] Law.lis.virginia.gov. Code of Virginia. Found on the internet at https://law.lis.virginia.gov/vacode/title64.2/chapter16/section64.2-1624/ This is different from a POA under Florida law, which requires you to list in writing each matter and affair in which your agent is authorized to act. [4] Leg.state.fl.us. Florida Statutes. Found on the internet at http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&URL=0700-0799/0709/0709.html

Other features

In addition to the four documents Trust & Will generates when you purchase the will-based estate plan, you’ll also gain access to the membership account. It’s free for the first year, then costs an annual fee of $19. From there, you’ll be able to share your plan, store other important documents or files, and make unlimited updates to your legal documents.

It’s generally recommended to review and update your will every three to five years, or in the event of a significant life change, such as a divorce, addition to your family, or if you’ve made a major financial change, like filing for bankruptcy or purchasing a home. Choosing a service that allows for updates ensures that your will accurately reflects your current wishes and any changes in your circumstances.

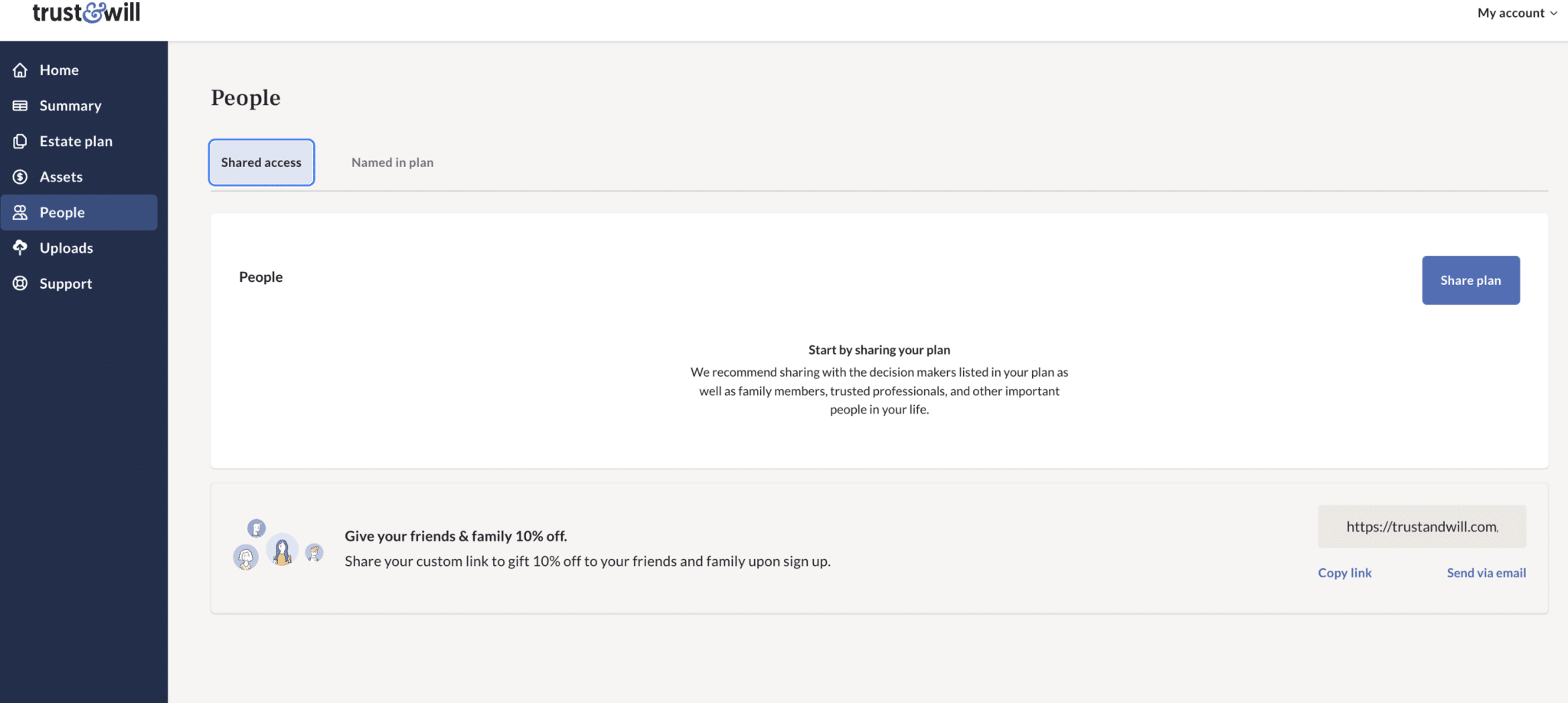

Share your plan

An important step after creating your documents is informing people you have named as decision-makers, beneficiaries, and executors of their role in your estate plan. With Trust & Will, you can share access to your documents entirely online by emailing an invitation to view your estate documents through the platform. You can also remove a person’s access to your account at any time.

Helpful hint: If at any time you want a reminder of which individuals you named in your estate documents, you can see the list by selecting the “Named in Plan” tab.

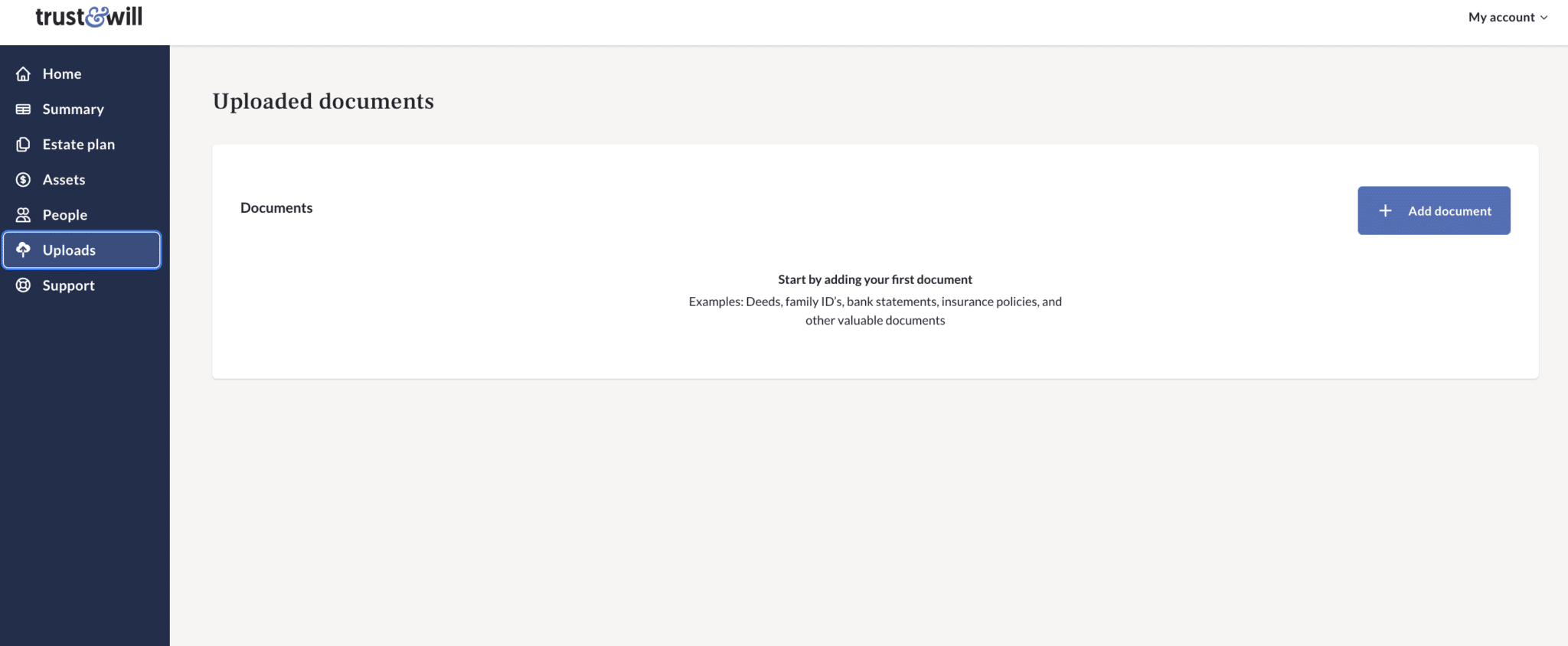

Document storage

You can conveniently store other digital and scanned documents (in addition to the estate planning documents) using the Trust & Will cloud storage service protected by a bank-level encrypted ⓘEncrypting information turns it into a digital code that adds an extra layer of protection. security system. To further protect customer information, Trust & Will underwent and passed Type 2 Service Organization Control 2 (SOC 2 Type 2) auditing, which provides an independent, third-party assessment of a service organization’s security over a period of time.

Some documents you might want to virtually store include:

- Identification documents

- Tax information

- Life insurance details

- Real estate deeds

- Car titles

- Letters to loved ones detailing final wishes or other final arrangements

Processing time

According to Trust & Will, the questionnaire takes most users less than an hour to complete, and the documents will be ready for download immediately. You can print them and take them to your local bank or UPS store to get them notarized that day. Upon notarization, the documents are valid and legally binding. Trust & Will offers to ship your documents to you with instructions and labeled folders. Your package should arrive within five business days.

If you need to have your documents executed as soon as possible—for example, you’re going on a trip or undergoing a medical procedure—we recommend printing them yourself. You can always request shipment later. The first shipment is free, but if you make changes to the documents and request a re-shipment, you’ll need to pay a $20 fee.

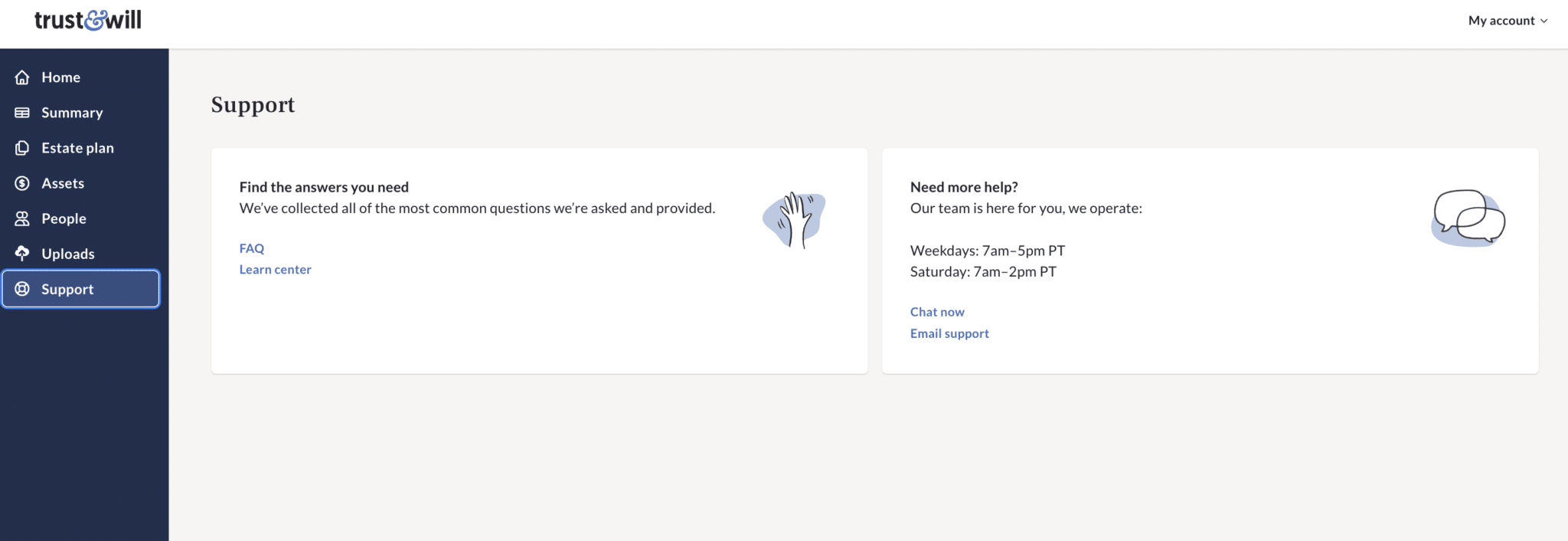

Trust & Will customer support

Trust & Will has a U.S.-based customer support center and is available using chat, form submission, email, and phone Monday through Friday from 7 a.m. to 5 p.m. PT and on Saturdays from 7 a.m. to 2 p.m. PT. We only waited five minutes to talk to an expert using the chat feature, and the wait for a representative to respond to an email or inquiry form was about an hour. We were surprised at the quick response, because it had taken competitors one or more business days to get back to us.

When our team used the chat while completing the questionnaire, the customer representative we reached gave helpful and clear instructions. The representative even stayed on the line while we finished that section to make sure all our questions were answered.

Another element we appreciated about Trust & Will customer support is how simple it was to reach out for help. On competitor platforms, contact information was difficult to find and sometimes only visible if you paid for the service. The Trust & Will chat feature is visible at all times before, during, and after the will-making process.

Trust & Will keeps all current promotions in one place, such as 25% off for health care workers and educators. It also offers a $10 discount to any first-time customer. If you forget to visit the promotion page before checking out, don’t worry. Before clicking “purchase,” a pop-up message appears with a reminder to put in the code “Gimmie10” for your discount.

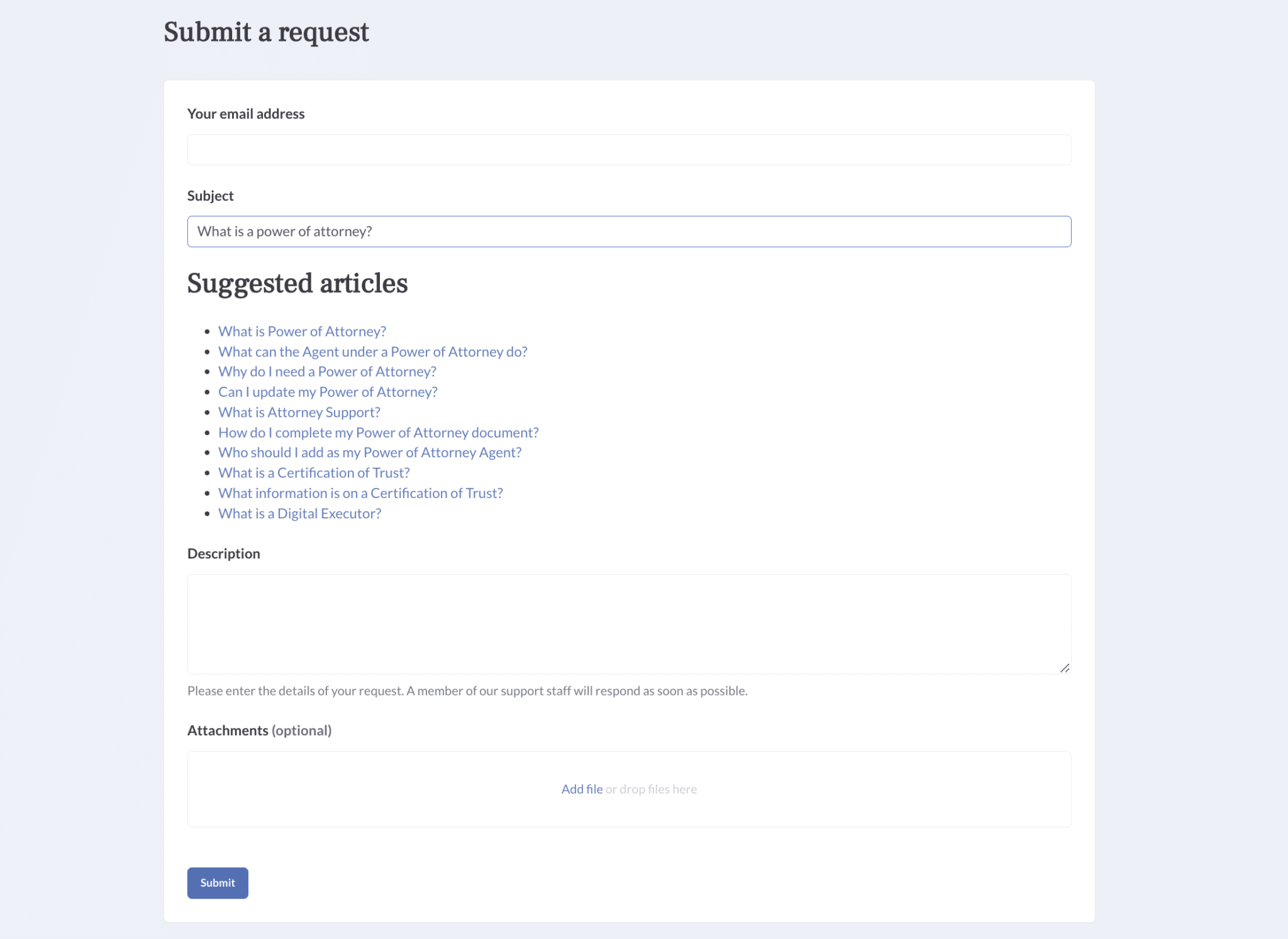

If you use the request submission process to ask a question, the platform will generate responses to frequently asked questions based on the user’s query in the subject line. This can be helpful if you are trying to get more information on a specific topic, but it can also be frustrating if you just want to get in touch with a representative.

The live chat feature is run by a bot, not an actual person. For most questions about the forms and the product, the bot will provide a thorough explanation. If you have additional questions or the bot isn’t covering the correct material, you can connect directly to a customer service representative within a few minutes.

Learn Center

If you want to learn more about estate planning in general, Trust & Will has many resources available in its Learn Center. All guides and informational articles are organized by topic on the Learn Center homepage. If you want to search for a specific topic, there’s a magnifying icon in the top left corner where you can search for a term within the article database.

Quiz

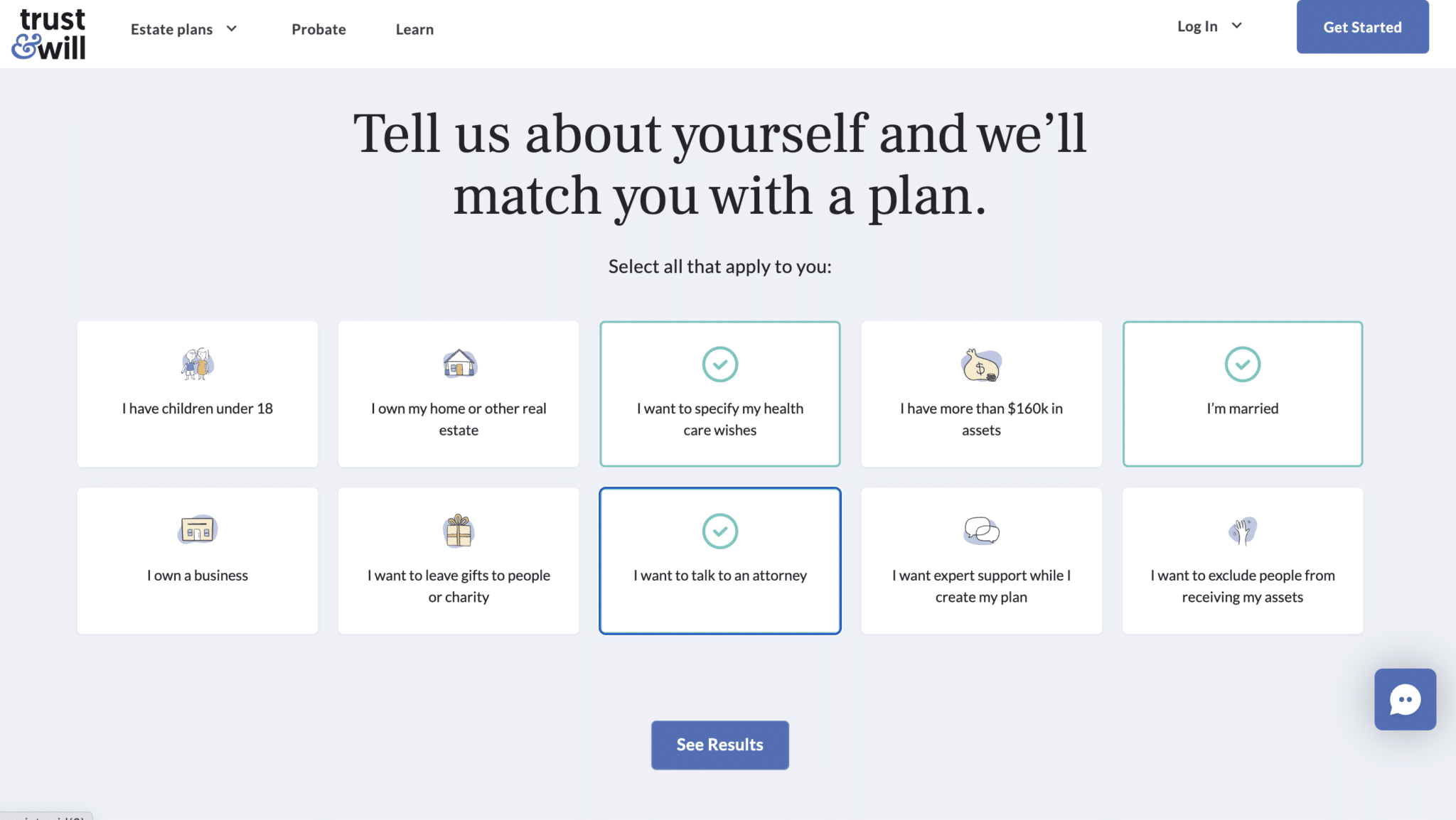

Before you get started, you can take the Trust & Will quiz to see whether its will-based or trust-based plan is more suitable for your needs. You can select as many options that apply to you as possible. After you select “see results,” the website will suggest the best option for your estate planning needs.

Satisfaction guarantee

If you aren’t satisfied with Trust & Will, you can receive a full refund within 30 days of purchase. To request a refund, you’ll need to send an email to support@trustandwill.com with your contact information. This process may take around five days.

The full refund only applies to the products and services offered exclusively by Trust & Will. If you purchased products from a Trust & Will partner, like attorney support or probate concierge services, you may only receive a 25% refund.

Trust & Will pricing: overall value

Trust & Will only has one online will package for $199, which has four important estate planning documents—last will and testament, living will, HIPAA authorization form, and power of attorney. Other online will makers may offer base packages at a lower price ($39–$99), but those packages don’t have all four documents. Overall, we found great value in the Trust & Will documents compared to competitors in the online estate planning space.

Like all other online will makers, Trust & Will takes credit card payments. But unlike most services, this company offers a monthly payment plan option that splits the total into four payments for no extra fee.

Comparison of best online will makers, as of 2025

| Price | $99 | $199.00 | $99–$209 | $19.99 per month* | $49.95–$129.95 |

| Attorney available | Yes | Yes | No | Yes | No |

| Wills for multiple family members | Yes | Yes | Yes | No | Yes |

| Satisfaction guarantee | Yes (60 days)** | Yes (30-day full refund) | Yes (30-day full refund) | No | Yes (30-day full refund) |

| Living will form | Yes | Yes | Yes | Yes | Yes |

| Last will and testament form | Yes | Yes | Yes | Yes | Yes |

| Durable power of attorney form | Yes | Yes | Yes | Yes | Yes |

| Free unlimited updates | Yes (30 days) | Yes (one year free then subscribe for $19 per year) | Yes (one year free then subscribe for variable fee) | Yes (seven days then subscribe for 39.99 per month) | Yes (one year free then included with variable membership) |

| Available in all 50 states (+DC) | Yes | Yes | No (not Louisiana) | Yes | No (not Louisiana) |

*Feature is an additional fee

Trust & Will add-on services

Along with generating four essential estate planning documents, Trust & Will offers add-on services for an additional cost, such as wills for couples, attorney support membership, mobile notary services, and probate support.

Wills for couples

If you’re in a long-term partnership, instead of paying $199 for a single will, you can pay an additional $100 for a will-based estate plan for couples. While the service can’t currently create a joint will ⓘA joint will is one document that addresses the plans for both partners., it will allow you to each create your own separate will from the same account and store important documents in a combined storage space.

Attorney support service

If you need legal advice about what to include in your living will or any estate planning questions while using the online service, Trust & Will offers an unlimited attorney support service you can add to your will-based estate planning package for $300 per year. Currently, this feature is only available to customers in 17 states, but Trust & Will is working on expanding to all 50 states. When our team asked when this feature would be available in all 50 states, Trust & Will could not provide an exact timeline.

Mobile notary

In a partnership with Mobile Notary Zone, Trust & Will makes it easy for you to make an appointment with a mobile notary who will come to you to notarize your estate documents. Mobile Notary Zone also provides the two required witnesses. This service will cost $145–$200 depending on the plan you chose, your location, and availability of appointments.

Probate support

This add-on service is for those entering, or within, the probate process. After a person passes away, with or without a will, a local probate court handles the distribution of assets. Trust & Will offers a support service in three different styles: self-guided, concierge, and attorney-led. This is not a service the person making the will would use, but the executor of an estate can purchase it.

Comparison of probate support services, as of 2025

Plan Options | Cost | Details |

|---|---|---|

| Self-guided | $600 |

|

| Concierge | $1,999 | All features in self-guided plan, plus:

|

| Attorney-led | $5,000 | All features in concierge plan, plus:

|

Trust & Will customer reviews

The Trust & Will reviews on Trustpilot show it has earned “Excellent” status, and more than 2,600 customers rated the service an average of 4.7 out of 5 stars. Additionally, Better Business Bureau (BBB) gave Trust & Will an A+ rating, but there are currently no customer reviews.

On Trustpilot, 89% of customers gave Trust & Will 5 out of 5 stars, highlighting how easy the platform was to use and recommending it to other users. Only 1% of customers gave Trust & Will 1 out of 5 stars, most notably complaining that attorneys were unresponsive, and the company applied unauthorized membership charges to their accounts. Service representatives have replied to more than 99% of customer reviews, either to thank the customer for their input, or to provide help to customers who reported a bad experience.

Bottom line

Overall, Trust & Will is a top competitor in the online estate planning industry. The platform is easy to use and offers assistance at every step of the process. With its premium service offerings at an affordable cost, Trust & Will is a good choice for anyone looking for a customer-first option when taking care of their estate planning needs.

Frequently asked questions

Yes, Trust & Will is a legitimate online will-making service that has been helping customers with estate planning since 2017. Although it’s a relatively new company, it has received more than 2,600 customer reviews on Trustpilot and has been awarded a rating of 4.7 out of 5 stars.

A will is a document that elects an executor ⓘThe executor is the individual responsible for distributing the estate and carrying out the wishes in a will.

and provides instructions describing how the will writer wants their estate to be distributed after their death. A trust, on the other hand, is a contract formed between two parties, a grantor ⓘThe grantor is the individual who is giving the assets to the trust.

and a trustee ⓘThe trustee is the individual responsible for managing the assets in the trust.

trustee.

The grantor transfers select assets to the trust that the trustee manages. The trustee maintains the trust on behalf of beneficiaries designated by the grantor. At a time specified by the grantor, the trustee distributes the trust’s assets to the beneficiaries. Unlike a will, you can distribute a trust at any time (before death, at death, or some point after death).

An estate planning attorney designed and approved every Trust & Will document template. An attorney doesn’t review your will after you create one. If you would like to have an attorney review your will, Trust & Will offers unlimited attorney support services for an additional $200 per year.

Have questions about this review? Email us at reviewsteam@ncoa.org.

Sources

- National Notary Association. 2023 Notary Fees By State. Found on the internet at https://www.nationalnotary.org/knowledge-center/about-notaries/notary-fees-by-state

- HHS.gov. Your Rights Under HIPAA. Found on the internet at https://www.hhs.gov/hipaa/for-individuals/guidance-materials-for-consumers/index.html

- Law.lis.virginia.gov. Code of Virginia. Found on the internet at https://law.lis.virginia.gov/vacode/title64.2/chapter16/section64.2-1624/

- Leg.state.fl.us. Florida Statutes. Found on the internet at http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&URL=0700-0799/0709/0709.html